Custom Fintech Solutions & Services

Custom Fintech Solutions & Services Fintech Digital Technology Solutions for Banking & Financial Software

Request Free Consultation

Finance Management Software Solutions

CIS helps you focus on offering next-gen services to your customer with our inventive telecom IT solution, which involves IoT, high-speed internet, VOIP & much more. You can ensure superior customer experiences & operational efficiency with custom fintech solutions.

Digital technology is evolving, and about every industry is leveraging its benefits to improve its processes, management, and customer services. Financial institutions are also rethinking their traditional delayed methods and slowly adopting the fintech solutions that define how they are providing their services.

Our Apex Fintech Services

However, the major challenge comes when it is time to find a dependable technology provider that can not only provide relief from the redundant methods of operations but also provide you with the accuracy and errorless approach you have had for years. Hence, CIS. Find high-end technology and Finance management software that allows you to efficiently manage your business anytime and anywhere. With elevated customer experience and quicker solutions, our finance industry solutions can help you generate a wider revenue stream without compromising on interactivity with your customers.

Services for Banking and Financial Institutes

CIS works with your bank and financial institute to provide a class apart technology experience and next-gen solutions. We provide you with digital banking solutions, mobile wallets, mobile banking solutions, cryptocurrency development, etc. We also provide you with an insurance management portal to elevate your user experience while allowing you to reduce the chances of error. Further, we do customer management solutions for a seamless experience. At CIS, you find the finance industry solutions that focus on your digital adoption while giving you automation, mobility, cloud enablement, analytics, AI-enabled customer support, and much more.

Challenges and Opportunities

-

Investment Shakeups

The Fintech industry is rather difficult to understand in terms of process and needs. While investors find it an unexplored ground to leverage for their benefits, it is not at all easy for them to know what works best. These practices of unknowingly done investments bring interference in the market.

-

Regulation

International and national governments have imposed some hefty rules and regulations to bear for the industry. Old policies thus do not support the intervention of the technology and benefits that come with it. It is important that governments adapt to the new trends.

-

Technology Haters

Business by far has been largely run on the old technology, and since money is involved banks, merchants, and people are hesitant to adopt to the new technology solutions that are not only secure and useful but far more superior.

-

Business Cycle

It is a long process, and revenue generation is slow. Fintech companies thus try to build revenue generation on a per-use basis and run-in high-risk zones without any affirmation on returns on investments.

-

The Big Market

It is a very big market, which is estimated around $25 trillion globally. Apart from some technology opposers there is still a large number of people who look forward to technology to evolve.

-

The Digital Age

The digitalization of financial products removes the physical constraint, which means now financial products can be designed using modern technologies that allow them to be more convenient and portable globally.

-

Hybrid Models

Given the portability of digital financial products, finding new and optimized cross-industry, hybrid business models open up a whole new world for mixing people with skills, institutional channels and proprietary customer sets.

-

More Access

Access to technologies, and increased use of mobile, cloud networks, and analytics is rapidly making financial products more and more available to all consumers and businesses.

-

Ongoing Need

The need and demand for financial services and products is higher than ever, technology intervention will provide core function in the lives of every consumer, business world.

Fintech Solutions For Banking & Finance Companies

Fintech solutions are a new and innovative way to approach financial services and business. Using digital assets and advisory services, fintech can provide a more efficient and updated system for banks, clearing houses, and other financial institutions. Fintech provides solutions for the financial services industry. This includes clearing, events, and banks. Fintech has updated and reads posts on commercial lending. Our webcast read post covers institutional banking, digital assets advisory, and press.

we strive to deliver the best work for every single project

Explore NowBanking & Finance Solutions

-

Net banking Portal

Give your users a sophisticated portal to access their accounts, our built fintech solutions are highly secure and technology driven to deliver your users robust net banking portals for your users.

-

Banking Mobile Apps

We build Android, iOS and Multi-platform banking applications that give your users the freedom to enjoy mobile banking on the go.

-

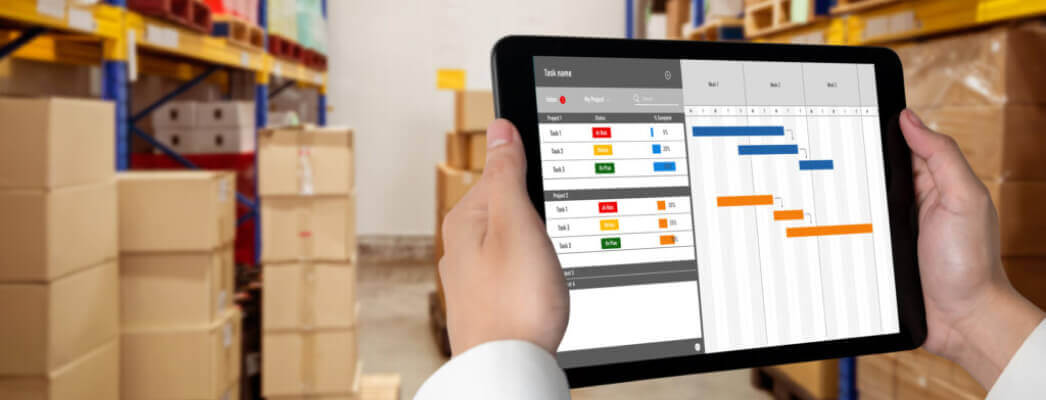

Finance Management Software

Dependable finance management software that helps you bring transparency in finance and transactions with advanced data security solutions.

-

Customer Management Solutions

Now, woo your customers with amazing customer experience with your financial institution. Our customer management solution allows you to build strong customer relationships.

-

eWallet App Development

Ewallet is one of the biggest trends ever in the industry. We give you out of the box Ewallet app experiences with class apart features and security.

-

Insurance Management Portal

We develop portals that are secure, futuristic, and help you manage your insurance company better with error rates next to nothing. It is an advanced solution allowing you to access your customer data, insurance plan and more.

-

Enterprise Application Integration (EAI)

Powerful technology solutions that help you get the needed ease in internal and external operations on the go, allowing you to streamline your processes for better experience.

-

Data Management Solutions

Manage your bunch of data without effort, get data management solutions by CIS that gives you the technology to secure your user data while also making data processing easier than ever before.

-

Credit Processing Solutions

Credit Processing SolutionsInteractive credit score checker software solution that allows your users to keep a track of your credit score for their better experience and B2C interactivity.

Why Choose Us?

-

Business Transformation

Streamline your business with unprecedented digital transformation, transform the organization's day-to-day activities, deliver precision in services, elevate customer experience, and reduce operational costs.

-

Innovative Acceleration

Our approach is for innovation, finding cutting-edge technologies and solutions for product designing, system architecture, and tech implementation to protect your business from the ever-changing dynamic of your business environment.

-

Improved Security

Finance of all industries has the biggest need for security in their operations, data, and information. At CIS, thus security is one of the most important parameters to keep your institute secure from any cyber threat.

Key Services

Rethink how businesses buy, pay, and invest by implementing a solid and efficient services stack.

-

Payment Gateways

Payment gateway integration is quick, safe, and guarantees a smooth checkout.

Mobile BankingThe most effective mobile banking options are safe, dependable, and long-lasting.

Simple IntegrationIntegrate financial technology into your current software to receive customized, risk-free solutions.

Omnichannel ExperienceAll significant international platforms readily link with our financial solutions.

Analytics and ReportingUsing trustworthy, illuminating analytics and reporting to assist in the planning of new business processes

-

Security and Compliance

The highest security and compliance standards support the financial solutions that help you succeed.

Risk ManagementWith this powerful tool, you can identify, evaluate, and manage threats to your company's revenue and capital.

Billing SolutionMultiple income streams can be easily managed using error-free, real-time billing software.

Fraud DetectionFraud protection and detection are made simpler and more effective with the help of our financial software solutions.

Robotic Process AutomationIncrease operational effectiveness and cut expenses by integrating financial RPA solutions.

Meet Your Business Challenges

Innovative and next-gen Fintech Software Solutions for a wide range of industries.

- A decrease in customer trust

- Customer Attrition

- Loyalty and CX that isn't satisfactory

- Weak Cross-Selling

- Disintegrated Customer Communication

- Customers' View Is Incomplete

- Fintechs face increased competition and more

- A decrease in customer trust

FinTech Solutions

We partner with several businesses globally as the world's top provider of FinTech solutions. Our extensive selection of FinTech Software Development companies gives our customers a top FinTech edge. All FinTech solutions abide by the banking laws and regulations of the relevant nation. You may be sure that the FinTech solutions provided by CIS are dependable, secure, effective, compliant, and resilient.

Loan Management Solutions

Our Fintech solutions company offers a range of financial institutions and specialized legal loan management solutions. You can screen, manage, track, and keep an eye on the performance of your loan portfolio using the adaptable features of our loan management software, along with numerous other crucial duties. We've integrated BI into our loan management software to offer comprehensive analytical capabilities, reports, and performance tracking.

Software Marketplace Connection

We develop marketplace lending solutions that assist loan originators in connecting institutional loan lenders with loan customers. Our marketplace lending platform uses contacts in the industry to provide loan seekers with the finest offers.

Individual-to-individual loan lending

The software for providing individual-to-individual loans enables loan transfers between people. It can be utilized to carry out loan-related tasks like taking part in loan processing and doing away with traditional banking support.

Expense Management Systems

Thanks to the effective, multilingual, and personalized expense management systems we design, you may make expenses across many expense categories and upload them to the cloud. Our cost management systems provide you with a comprehensive snapshot of your expenses so you can keep informed.

Credit Assessment Solution

Our credit evaluation tool is the best in the business. It enables an insight-based evaluation of many demographic and behavioral parameters, hastening the loan decision-making procedure.

Digital Wallet Solution

Our FinTech developers create digital wallets that support bill payment, mobile recharging, and money transfers. They also develop point or reward systems to encourage users to add value to their apps.

Gateways for Custom Payments

As financial institutions require, we develop specialized, secure, and reliable payment gateways that enable safe payments using OTP verifications and various authentication and verification techniques.

Cyber Infrastructure, CIS, is the right choice for customized and secure FinTech solutions.

These ten factors make CIS the top FinTech solutions provider in India for international markets.

-

High-Customizable FinTech Solutions

Our fintech solutions are specifically designed to meet the needs of your business, sector, and customers. Moreover, we guarantee peak performance. We provide FinTech solutions that are made to fit your requirements and assist you in providing for your customers.

-

Assurance of Regulatory Compliance

FinTech solutions are developed in compliance with each country's applicable regulations and rules. You can rest assured that you will receive the best FinTech solutions and compliance from us.

-

Easy Integrations with Third Parties

We facilitate third-party integrations so that they can take full advantage of the features of our financial technology platform.

-

Integration of Automation Features

Numerous automation tools built into our software enable us to automate repetitive processes like reporting and replying fully. Thanks to this software, you can save time and skip the tedious process of conducting these duties manually.

-

FinTech Software Developers Team

For your company, our FinTech software developers offer specialized FinTech solutions. Our programmers have a wealth of knowledge in creating financial technology solutions. Our programmers focus on delivering solutions that will help you succeed and increase your company's value over time.

-

A Dedicated Project Manager

We designate a professional manager for your project to ensure smooth communication, faultless execution, and regular updates on the project's progress.

-

Facilitation of FinTech Resources

We assist businesses with FinTech resources in addition to offering FinTech solutions. We also operate as your hiring partner, assisting in recruiting FinTech specialists on a contract-and-full-time basis.

-

Experience and Clientele from around the Globe

Our Fintech app development company has been operating for over ten years. We have long-standing clients in every country. We can work on challenging projects, which gives us an edge in the financial technology industry.

-

Secure FinTech Solutions

Security is a feature of our financial tech products. They provide secure money transactions and data security using modern technology and solutions.

-

A wide range of FinTech Solutions

We provide several financial technology options that can be utilized to satisfy the various requirements of enterprises. Digital wallets, loan management applications, mobile apps, payment gateways, and spending management tools fall under this category.

Industry Solution

See how CIS help in Enterprises success